Disclosure: I have made an almost no profit-no loss in the two rights issue transactions (on a net-net basis) over the past one month. This blogpost is just to document my experience and learnings rather than any profit making opportunity. I spelt out the disclosure upfront so that there are no expectations on any profit-generating opportunity blogpost.

There were two interesting Rights Issues over the past one month. The record dates of these two rights issues were in fact only differed by a day. At the end of it, I gained valuable experience in how to invest (or not invest) in these issues and eked out a small profit.

The first Rights Issue was that of Arihant Superstructures.

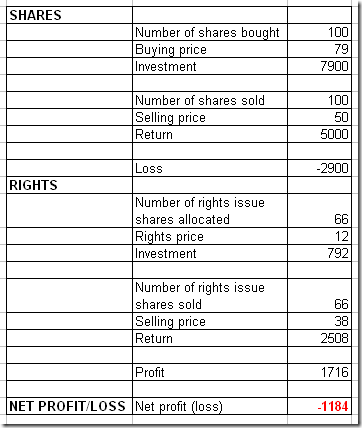

Arihant Superstructures (ASL) offered rights to buy one share of ASL at Rs. 12/- for every two shares of ASL held as on record date (which was 02-May-2012). The price of ASL before the record date was announced was around Rs. 65/- and by the time I saw the announcement and bought 100 shares on 27-Apr-12, the price quote was around Rs. 79/-. It went on to hit Rs. 85/- subsequently before it hit Rs. 52/- on the record date (and I was able to sell my 100 shares at around Rs. 50/-). I applied for 1000 shares (although I was eligible only for 50 shares – that’s one of the main advantages of a rights issue).

Then struggle started. I did not get the Rights Offer letter till 21-May-12 and the closing date was 25-May-12. I was more than a little worried and after a few twitter interactions with good samaritans Prashanth and Viral, I contacted my broker (Sharekhan) who very obligingly (20 min call) told me that they can apply on my behalf.

Last week, I came to know that I was allocated 66 shares, a 30% allocation over and above my limit, but far below my greed level of 1000 shares.

So my profit/loss amounted to –

Lessons Learnt:

a) May 01st is a public holiday and the markets don’t work on that day. I had to realise that if the record date was 02-May, the ex-rights date should have been 30-Apr. Next time, look out for public holidays, Saturdays and Sundays for calculating the ex-rights date.

b) My share buying date was 27-Apr-12. Due to T+2 settlement date, or for some strange reason, the registrar didn’t have my name on the ‘Eligible for Rights Offer’ record. This resulted in me scrambling around, asking for help and being in a very long conversation with my broker. Next time, try to buy the rights issue atleast a week before the record date so that no such hullabaloo happens.

c) Rights issue, in the current scenario may not be as profitable as it was 5 years back. There are just too many investors (and investment funds) waiting for such an opportunity. Maybe 1 out of 5 rights issue may give you a great return. Expecting every rights issue to give a great return is foolishness and will lead to disappointment.

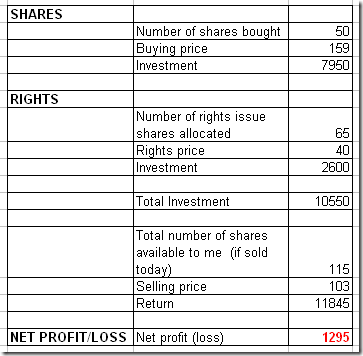

The second Rights Issue was that of EPC Industries (EPC Irrigation).

EPC Industries offered rights to buy three shares of EPC at Rs. 40/- for every five shares of ASL held as on record date (which was 03-May-2012). The price of EPC before the record date was announced was around Rs. 150/- and by the time I saw the announcement and bought 50 shares on 27-Apr-12, the price quote was around Rs. 159/-. It went on to hit Rs. 165/- subsequently before it hit Rs. 110/- on the record date (and I didn’t sell my 50 shares in this case). I applied for 1000 shares (although I was eligible only for 30 shares).

This time I did receive the Rights Offer letter and there was no running around. The offer ended 31-May-2012, but they extended to 01-Jun-2012 due to nationwide bandh. I went to ICICI Bank (which was the Banker for this issue) on 28-May itself (thanks to Neeraj for urging me on) and submitted a cheque along with the letter of offer and that was that.

Today, I called up the Registrar of the Issue and the Registrar did inform me that I was allocated 65 shares, a full 100% over and above my eligible allotment but yet again below my greed of 1000 shares.

Let’s look at the profit/loss in this case (CMP: Rs. 103/-)

Lessons Learnt:

1) I have a Citibank account (and no other bank account). However, if I need to enable ASBA during this rights issue (and thereby not lose interest component for these 15-20 days), I needed to have 1 of the 7 banks that are approved by SEBI (also called Self Certified Syndicate Banks) (list here) and the list doesn’t include Citibank (which I found out a day before I applied for the offer). Therefore, I had to give a cheque and thereby lose the interest component for 15-20 days. I am in the process of opening another Bank account just for this purpose so that next time I won’t repeat this mistake.

2) Keep a lookout for external events like Bandhs/Bank holidays and ensure you submit the completed rights offer letter much before the end date. I didn’t commit this mistake now, but I had to jot it down not to miss this risk the next time.

3) Yet again, don’t dream that every rights offer will get you awesome returns. In fact, for this rights issue, I had calculated that I would buy a smartphone from the profit proceeds 🙂 Didn’t happen (darn!) 🙂

As I stated earlier, net-net, I hardly made a profit or a loss. However, since these two applications were my first foray into rights issues, I am totally ok with the result but a ton of learning. (I was in one country or the other traveling on work whenever any rights issue happened since I came to know about this special situation about 1.5 years ago).

Let me know if you have any questions/queries/inputs. The only question I have is – Is there any way in which you can know if you can get more than a 100% allocation to your eligible allotment or not? If there is, do let me know.

For the first case, i didn’t get, why you mentioned your selling price as 38/- for the additional 66 shares? It should be 50 right ? Because while calculating profit you already took cost into accont 2508-792 = 1718/-.

Regards

Raja

Ooops !! Now i realize, you were able to sell the 66 shares only for 38/- 😦

yep, the 66 shares as part of the Rights offer got allocated only recently and by then the share price had corrected to Rs. 38/-. I don’t like the company’s financials or the management or the potential as such (unlike EPC Irrigation). Hence played it only for the rights issue. And therefore sold it before it corrected further 🙂

Hi, have the shares been credited into your demat account for EPC. I did this for first time, and though my ASBA bank was ICICI, my demat was with kotak. So just wanted to check.

And yes i agree expecting a massive return seems difficult, as everyone seems to be waiting for such issues 😦

Hi Kiran,

Rights issue happens because company seeks new funds for expansion or for other things.

Here, company is not doing any thing good that will entail its share price increase on the bourses.

People have misplaced conception that they would be able to make a profit out of it but that is not the case.

Please allow me to explain.

In your first case:

1 share at Rs. 12 for every 2 shares held on the record date. As you said the price just before the announcement was Rs. 65.

So, you invested

65*2 = 130 + 12 (for 1 shares) = Rs. 142 for these 3 shares

That means your average buying of 1 single share has come down to = 142/3 = Rs. 48.

So, that why you saw that the share price fell to Rs. 50 after after record date.

Happy to be contradicted.

Thanks,

KP

By the way, your other posts are good reads and I myself learnt a hell lot from them.

KP

Hi Kiran, Just wanted to know the most efficient and fastest way to track Rights Issue Announcements. I tried the Screener Rights Issue link provided on your blogroll, but I observed today that it doesnt display all issues (it didnt even show Arihant’s issue)

@Saurabh – Nope, the EPC shares have not been credited yet. The Registrar said it may be credited in the next 1-2 days. I came to know of the allocation only because I called up the Registrar.

@KP – That calculation is true in most of the cases (and usually that calculation is done from the last quoted price before ex-date and hence the price corrected to Rs. 56/- first and then slided down further). However, there are some rights issues where the price doesn’t follow our arithmetic for some strange reasons (look for Neuland Laboratories Right Issue – case in point, price didn’t correct at all after the record date). So – yeah, the answer is arithmetic in most of the cases, no particular logic in other cases. Every time you get into a rights issue, you just need to assume that arithmetic will be followed and in case it doesn’t, it’s a bonus.

@Ashwini – That link usually works – I am surprised it doesn’t have Arihant. I usually track BSE and NSE announcements.

Hi Kiran,

I have also tried my first Rights Issue with EPC… plz find my exp….

1. I have brought 250 shares of EPC @ 169Rs on 27th April and ex-date was on 2nd May 2012, record date as 3rd May-2012.

2. I sold my shares on ex-date @ 116 (2nd May-12), and waiting to recieve my first rights issue form.

3. I was in touch with the sharepro services registrar for the issue about my CAF form, he told my name was not in their records…

4. Neeraj guided me to check with my broker as the shares I sold on ex-date will be in pool acc of my broker.

5. If I remember correctly I narrated my problem & also about rights issue to about 10 customer service people of my broking firm…none of them r helpful..

6. Finally I am able to contact the manager for demat desk… and she understud the prblm of shares being held in their pool acc…

7. They recieved the CAF form, and they renounced their rights to me …. (not wat I expected)

8. So here I became a renouncee… ( as per letter of offer… renouncee’s will be given least priority in allocation of additional shares).

9. I applied for 1250 shares (out of which my eligbility was 150 shares).

10. As a renouncee we cannot use ASBA … so I gave a cheque leaf for the amt. at the banker to the issue.

11. Yesterday I got refund from EPC …. and I understood they alloted only 150shares to me..to which I am eligible.

12. Loss from Buying and selling of shares ==> ( 169-116)*250 = 13,250

13. If I sell the shares avilable to me @ today’s price (102) ==> 150 * 102 = 15,300 ( the stock may correct to 80rs once the new shares are alloted …i’m not sure about this, but if thats the case…then I will end up with gaining some knowledge in rights issue @ some price)

===================

In brief I learnt,

1. Depending on certain brokerage firms, if u sell on ex-date..ur name will not be in registrars records.

2. So u have to struggle a lot in making people at ur brkrg firm understand about the rights issue and get the rights renounced to you.

3. Renouncees will get least/no pref in allotment of additional shares.

4. Renouncees cannot avail ASBA facility.

==========================

I just want to convey my thanks to Neeraj in replying to all my queries very patiently on time, which made me to get the rights renounced on my name….

@ Kiran-Thanks. Got the credit today.

@Ravi – You mean, you had to give a cheque to the Banker of the issue? I am surprised. In Arihant’s case, my broker (sharekhan) applied on behalf of me. I am not sure if they renounced it to me and then applied or they directly applied on behalf of me. In fact, when I applied for 1000 shares, they debited 12000 from my account (which had a zero balance) and now my account was showing -12000. That is, I didn’t even have to have money in my account for them to apply.

As you said, I guess it is different from broker to broker. In fact, the learning is don’t rely on any broker. Apply for the rights issue one business week before the record date so as to avoid any hassles.

Hi Kiran,

For me IciciDirect had renounced the shares, so I have filled Part-C of the CAF form.

I requested them to apply on behalf of me…. they agreed, but when I received the form… There is a letter from the manager mentioning that they had renounced the shares to me….

For renouncee there is no ASBA facility available, this i have confirmed with Registrar for the issue.

Just wanted to know, if you sell shares on ex-date in sharekhan, does your name visible in books of the company??

I sold off my shares today in EPC… gaining a lil bit profit …. i’m happy finally as my first rights issue was success…. 🙂

Kiran, if you are free… can you provide your views for sundaram-clayton demerger (is there any money making opportunity present in that SOA ?? )

@Spendasulike – They sent you a form? For Sharekhan, neither did they send me any form nor did I fill any form. It was completed over one phone transaction (so maybe, its just pure blind luck that I got a informed agent on the line).

No ASBA facility for renouncees too, eh? Hmm..good info to complete a checklist of errors not to commit 🙂

I usually sell on record date just to avoid any confusions on dates. But in conversations with other investors, selling on ex-date also works pretty well is what I gather (as in, no running around brokers etc.).

Congrats on your first successful rights issue 🙂 As I said in the post, since more and more people know about this concept now, the chances of superior blockbuster returns is going to be very low in the future.

I am still analysing the SCL de-merger. I currently have no views on it. As it is, the court decision in such cases may take anywhere from 2-6 months. So, there is no hurry in investing in SCL without the necessary due-diligence. Will let you know if I complete my analysis.

Have you received EPC shares in your demat?

Hello Kiran and your article made a very good raed and I follow you in other forums.

Though not quite complicated as the ‘Special Situation’ you specialise in, what is your opinion of the fall in ‘Zylog Systems’? Prima facie it is selling of plegded shares….does not seem a fraud. So do one invest it or follow of the often said quote ‘do not catch a falling knife’.